Corporate M&A functions exist to do M&A, that is their sole purpose

Participating in deals, placing losing bids, etc. don’t make up for not getting deals done

For every deal that goes through, there are several that fail. For various reasons, some are in your control, others are not

Every deal requires effort, right from evaluation to issuing termsheet to diligence to placing & winning final bids to documentation and closing. The longer a deal goes on, more the effort that is spent

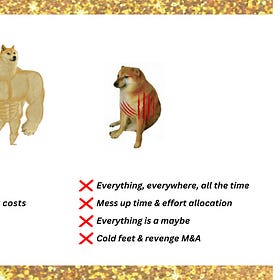

Understanding the concept of sunk cost, is important. But understanding opportunity cost is even more important for success in corporate M&A

You only have as much time and resources on hand while doing M&A. At any point in time, you can evaluate and bid on a limited number of deals and have to seek success within the deal set

Seek better deals or sit out, if you are not content with the quality of deals you are getting to look at and save your breath and effort. Don’t participate half heartedly in deals that are of low interest

Losing out by placing low ball bids is amongst the worst possible ways to lose out on deals. You didn’t just underbid the target, you also devalued your own effort and let it go waste

When you encounter an asset that you like, bid to win. Sure, you don’t have to overpay and you can walk away if that is the scenario unfolding. But, don’t shy away from paying up and securing the deal

A good acquisition done today, starts yielding results and progresses your strategic goals - surely & sooner than hypothetical acquisitions done in the future

Do keep these in mind, when you are doing corporate M&A.

This is part #4 in the thread on what corporate buyers ought to keep in mind while doing M&A. This below is the link to part #3, posted last week.

Saving Corporate M&A (Part 3) - Intent Over Volumes

Last week’s post was about hype cycles and how making these the central to your investment case can be harmful. You can read more on that below -