Why Hypergrowth Will Return

Hypergrowth is an outcome of the rise of the global internet. It may ebb & flow, but it is here to stay, for the lack of any workable alternatives

The pre-internet era

Imagine you lived in a small town in the early 1990s. Back then, the internet didn’t exist for the average person. All commercial or utility establishments that you could access and use were most likely local. The local bank branch, the local school, the local grocery, the local restaurant, the local hospital and so on. And, each such small town or community had their own such franchises to serve them. In the parlance of current times, the TAM of these establishments was limited to their immediately proximate community. Competition was also local. It was all local.

Online commerce & its two eras

The emergence of the internet for use by businesses and the average consumer, has probably been most significant evolution in the history of commerce, since mankind started to trade. But, before I delve deeper into this topic, let me define the two eras- the early era and the current era. These two eras are not discrete in terms of timelines and both are continuing as we speak.

The early era can be said to have begun during the dotcom days and continues to this day. The characteristic of this era was the rise of internet enabled businesses that challenged the local brick & mortar businesses of the past. Think online ticketing, email, online search, internet banking, e-commerce, etc. These business models did not have the constraints of geography that brick & mortar businesses had. Right at start, these online businesses could aspire to do business globally. And there was ample capital from investors, funding this opportunity. Thus online businesses have been able to steadily take away market share from brick & mortar businesses. But perhaps the most visible outcome of this era was the change in the leadership hierarchy across industries, with online businesses becoming market leaders by replacing older brick & mortar players. Think Amazon, Netflix, PayPal, Booking.com and so on.

The success of the early era led to the current era, which started after the dotcom bust, but gathered momentum after GFC, with further mushrooming of online businesses and rise of unicorns, fueled by technological advances, easy access to capital and continued iterations of business models. And the current era is throwing up companies that are challenging the leaders of the early era. Shein, Disney+Hulu, 10-min delivery cos, BNPL apps, short form video, etc.

In the current era, no business is safe. Brick & mortar businesses have to anyway deal with creeping takeover of market share by online businesses. And online businesses have to keep looking over their shoulders for competition. Even the market leaders have to keep a wary eye out for anyone else catching up with them.

Only workable strategy?

And this brings us to the strategy that most online businesses gravitated to, in the current era - hypergrowth i.e. to grow & grow faster than others. But, you might wonder, why did this situation ever arise in the first place? Why did online business all kind of gravitate to hypergrowth?

You see, just as the internet extended the TAM for online businesses, the internet also increased choices for customers. With switching costs being low to none. And suddenly, the earlier (& textbook) approach where businesses could carve out their niche by carefully studying customer behaviour and deciding on which customers to serve and how to serve, while maximising their profits, was not working. Competitors were breathing down each other’s necks. And thus began the search for that elusive niche which one could dominate and monetize to heart’s content. But every time, an online player launched a new product or a new category or entered into a new market and so on, competitors soon followed. Differentiation became transient to non-existent. And with that went the prospects for profitable monetization.

Ignoring hypergrowth & staying within your niche was not a great option either as customer loyalty could not be relied on. Lower prices, higher discounts from competitors were often strong enough to wean away customers and blunt any edge built around product or service quality.

All in all, nothing else seemed to work. Hypergrowth had its own set of problems, but at least it allowed for online businesses to stay in the game. Besides, capital from investors was ample, with larger scale being attributed higher valuation. So, even if there were any doubts in the minds of businesses about hypergrowth & unsustainable economics, the validation that came from fund raising, would have put those doubts to rest. Thus began a feedback loop of hypergrowth, being validated by higher valuation & access to the next dollop of capital to drive more hypergrowth.

2022 & beyond - what is coming up

In 2022 (or more accurately, since Nov 2021) there has been a souring of market sentiments, leading to this funding winter for online businesses, as the markets wind down some of the valuation excesses of 2020-22 . And to make things worse, we are now coming to terms with the prospects of the global economy being subjected to a long and painful period of rising interest rates to stamp out supply side inflation.

But, do keep in mind, the two factors that drove hypergrowth business - internet and capital availability, are still around and in promising health.

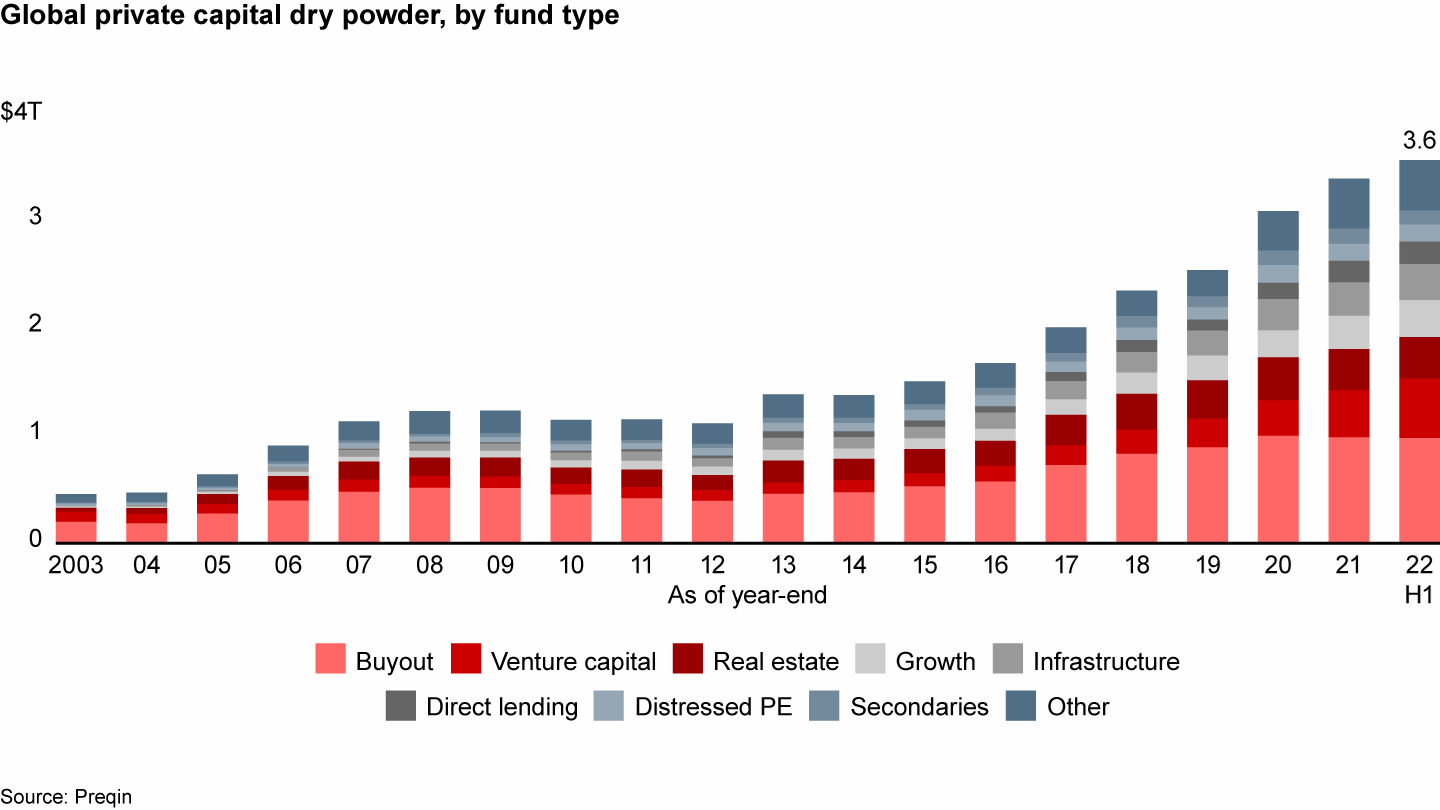

Say what you will of investor appetite to invest in these markets, but dry powder (cash and commitments) is at an all-time high of $3.6 trillion, as seen in this exhibit below from Bain’s mid year 2022 private equity report. And investors cannot wait indefinitely to deploy this dry powder. Sooner or later this money will have to be invested.

What of the internet? Penetration continues to rise. Online transaction volumes continue to rise. And outside of autocracies like China, Russia, etc. there are limited barriers on the internet.

But you might still wonder, why wouldn’t investors want to enforce better discipline in portfolio companies in return for growth capital? After all, hypergrowth will not really work without capital - will it? Also, why wouldn’t founders, want to get off the hypergrowth treadmill and instead aim for more deliberate growth and build sustainable economics?

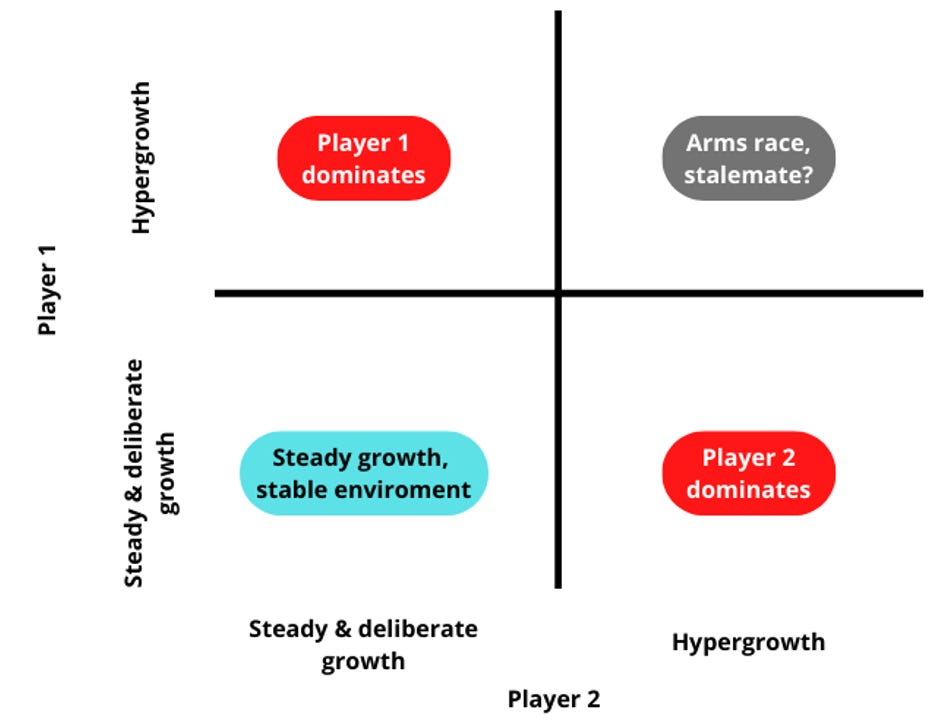

Well, investors & founders will definitely try to make a break from hypergrowth, in the near term. But any such change is hard to sustain for long. Why this dark prognosis? You see, there is this teeny weeny stumbling block on that path to steady growth + profitable operations + disciplined capital allocation - it is human psychology. There is a large upside to a company if it chooses hypergrowth, as long as its competitors don’t. Think Nash equilibrium and the drive to win. Hence, when capital is abundant & internet is free, there is little disincentive but instead a strong incentive to hypergrow.

Hence, it becomes a game of who blinks first and reverts to hypergrowth. After that, everybody else - companies & investors, will have to (un)willingly dive back into the hypergrowth ocean, else risk a poor outcome for themselves.