Thank you for tuning in. Last week’s post was about understanding how businesses do disservice to themselves by taking an “opportunistic” stance in M&A and losing out on buying high quality businesses when the opportunity actually comes. You can read more here -

Saving Corporate M&A (Part 1) - Trend of Trends

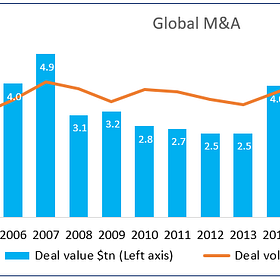

Observe this graph below carefully. Source: IMAA Institute Note, how M&A deal value and volumes ebb & flow. Note the peak years - 2000, 2007, 2015 and 2021. In these years, both deal values and volumes peaked. Note the behaviour in the low years also - 2002, 2013, 2020 and 2023.

This week, let’s talk about another guiding principle for buyers to keep in mind when considering M&A. This is about discriminating between hype and the threat of disruption.

Gartner regularly publishes hype cycles, which document the emergence, maturity & decline of hot themes. Sample these hype cycles from 2017 to 2023.

The themes at the peaks are no surprises of course, them being the most popular & widely chased/covered ideas for financing and deal making in that time. But, pay close attention to just the sheer number of themes emerging in each cycle and dropping off soon after. Internet of things, connected homes & 3D printing had their time in the sun, displaced by mobility led themes be it cars or space, in turn disrupted by the infamy that were NFTs and web3 and today GenAI is all the rage. Sure, some of these themes have matured and have seen adoption happen. But for every such success, there are several other themes that never lived up to the hype. And it is this hype-drop cycle that one has to be careful while investing or doing M&A.

Now, you could argue that chasing the “flavour of the season” afflicts the financial investor way more than the corporate buyer and yes there is truth to it, but corporate buyers have also taken to trend watching to stay alert for eventual disruption. And corporate buyers also know that disruptions can be rapid and, past a certain point, uncounterable. A wait and watch stance risks missing life altering opportunities ala Yahoo with Google, Facebook or Netflix or even the recent Adobe & Figma saga. If Figma were acquired when it was smaller or in an earlier timeframe, it arguably would have gone through just fine with the regulators. There will certainly also be examples of buyers being too early in doing M&A and not getting the desired upside. But these pale against the what-could-have-beens.

In a world, where the need to look out for disruptive trends has now largely been mainstreamed amongst Corpdevs and CXOs, here comes the next iteration to this issue - how to separate genuine disruption from the hype and how to time your entry into these trends. Let me give you an example - GenAI is all the hype and buzz today and for good reason. But here is the hype part of it - there is a growing trend amongst acquirers currently to be very very curious about what is the “AI strategy” in target companies, regardless of what business the targets are in. Are the targets using AI in their operations? How long have they been using it? How is this usage to be scaled up in the future? If AI is not prominent in the target’s scheme of things, why are they so foolish and how soon will they be out of business? You get the drift. Sure, AI will disrupt how businesses operate, but having an “AI strategy” or adopting AI today is no guarantee that such businesses will not get disrupted by further improvements in AI or worse, by *gasp* late adopting competitors. This is because rapidly emerging trends, often contain within them several sub trends that are competing for leadership and victory does not necessarily gravitate to the best. Think of DVD format wars or the tape format wars before that. And imagine the plight of those that boarded the wrong boat, coz they certainly were early.

Stay tuned for next week.

P.S. - How do you time your entry into disruptive trends? Let’s address that later, but safe to say, such answers are not cheap.